What Is a Gift Annuity?

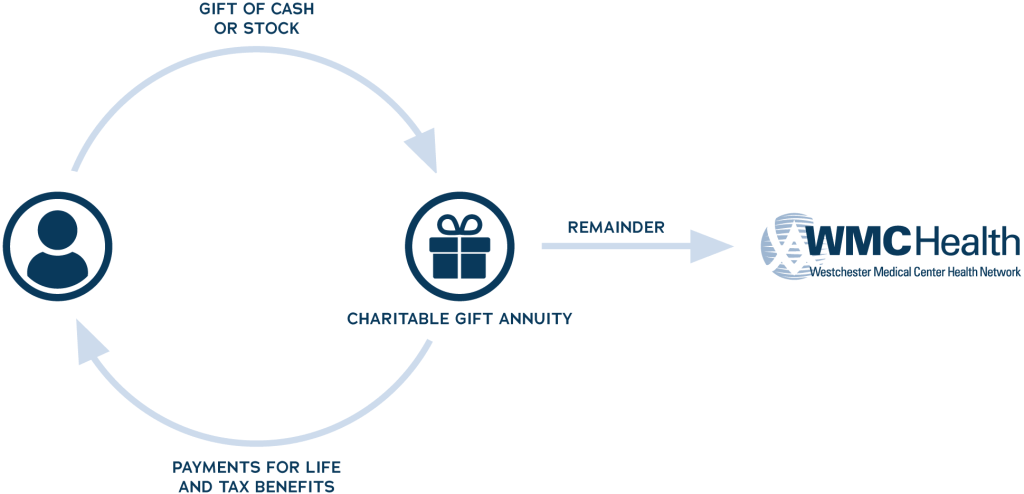

A charitable gift annuity is an excellent way to support WMCHealth and receive lifetime income for you and/or loved ones. It is a contract between you and WMCHealth Foundation. After you transfer cash, marketable securities, or other assets, WMCHealth agrees to pay a guaranteed fixed income each year to one or two individuals for their lifetime. Once the annuitants have passed, any remaining funds will go to support a hospital and/or program of your choice.

Benefits of a Gift Annuity

There are many benefits for a gift annuity for you and loved ones.

Gift Annuities Attractive During High Inflation.

Since payments from a gift annuity are fixed and backed by the entire assets of WMCHealth, they offer security during uncertain economic times, including during a high inflationary period. The gift annuity payments do not rise or fall with stock market values.

Contact Us!

We are eager to answer your questions and offer personalized illustrations to you of the potential income and tax benefits with no obligation. Please contact Susan Gerry at 914-493-6304 or Susan.Gerry@wmchealth.org for more information.

Please consider a charitable gift annuity as an outstanding way to help you and loved ones, and for leaving a legacy supporting the important mission of WMCHealth!

New Opportunities for Gift Annuities.

As of January 1, 2023, two recent developments offer increased benefits for gift annuities.

First, the payout rates for gift annuites have increased. Please contact Susan Gerry at 914-493-6304 or Susan.Gerry@wmchealth.org to explore your charitable gift annuity rate(s).

Second, a new law permits tax-free rollovers for those age 70.5 years and older from his or her IRA to fund a charitable gift annuity. This rollover is available for one year only, at your choice, and for a maximum of $50,000. The gift annuity created by this IRA rollover (also known as a Qualified Charitable Distribution or QCD) can only make payments to the IRA owner and/or his/her spouse. The QCD for a gift annuity will also count towards your annual required minimum distribution (RMD). While the QCD for a gift annuity does not permit an income tax charitable deduction, there will be no income tax owed on the rollover to fund the annuity.